Unlocking Tax Efficiency: Montenegro Legacy Trust Strategies for 2025

Are you concerned about preserving your wealth for future generations while minimizing tax liabilities? With global tax regulations constantly evolving, high-net-worth individuals need sophisticated solutions that offer both asset protection and tax optimization. The Montenegro Legacy Trust presents a compelling opportunity for international investors seeking to navigate the complex landscape of wealth preservation.

Understanding Montenegro's Trust Framework

Montenegro has emerged as a premier jurisdiction for wealth management through its innovative trust legislation. The country's legal system combines civil law traditions with common law trust concepts, creating a unique hybrid structure that offers exceptional flexibility and security. This legal framework provides robust asset protection while maintaining compliance with international standards.

The 2025 updates to Montenegro's financial regulations further enhance the jurisdiction's appeal for legacy planning. These changes refine the tax treatment of foreign-sourced income and introduce clearer guidelines for trust administration. Financial experts from the Global Wealth Advisory Group note that "Montenegro's progressive approach to trust law creates unprecedented opportunities for international estate planning."

Key Benefits of Montenegro Legacy Trusts

Asset protection stands as a fundamental advantage of establishing a Montenegro Legacy Trust. The jurisdiction's laws provide strong safeguards against frivolous litigation and unauthorized creditor claims. This protection extends to various asset classes, including real estate, financial instruments, and intellectual property rights.

Tax optimization represents another significant benefit. Montenegro's territorial tax system generally exempts foreign-source income from local taxation, while the trust structure itself offers additional layers of tax efficiency. The 2025 policy revisions have clarified the treatment of capital gains and inheritance transfers, making planning more predictable.

Succession planning becomes more streamlined through proper trust administration. The structure allows for smooth intergenerational wealth transfer while avoiding the complexities and publicity of probate proceedings. This ensures your legacy passes to intended beneficiaries according to your specific wishes.

Implementing Your Tax Optimization Strategy

Choosing the right trust type forms the foundation of an effective wealth preservation strategy. Montenegro offers several trust variants, including discretionary trusts, fixed trusts, and purpose trusts. Each structure serves different objectives and requires careful consideration based on your specific circumstances.

Proper asset segregation proves crucial for maximizing protection benefits. The trust must maintain clear separation between personal assets and trust property. This separation strengthens the legal integrity of the arrangement and enhances protection against potential challenges.

Selecting qualified trustees ensures professional administration and compliance. Montenegro's regulated trust companies provide experienced management while adhering to international compliance standards. The jurisdiction's robust regulatory framework offers additional assurance regarding proper oversight.

Navigating Compliance Requirements

Understanding reporting obligations remains essential for maintaining trust validity. Montenegro requires annual filings and regular updates to trust documentation. These requirements align with international standards while being less burdensome than many other jurisdictions.

Anti-money laundering compliance forms an integral part of trust administration. Montenegro's regulations incorporate latest international standards, requiring thorough due diligence on settlors and beneficiaries. These measures protect the jurisdiction's reputation while ensuring legitimate wealth preservation.

Tax information exchange agreements affect how jurisdictions share financial data. Montenegro participates in multiple international agreements while maintaining appropriate privacy protections. Understanding these networks helps in structuring trusts for optimal confidentiality.

Addressing Common Implementation Challenges

Proper documentation establishes the legal foundation for your trust arrangement. The trust deed must clearly outline terms, conditions, and distribution parameters. Professional legal assistance ensures all documents meet Montenegrin legal requirements while reflecting your specific intentions.

Funding the trust requires careful attention to transfer formalities. Different asset types involve varying transfer procedures and potential tax implications. Proper execution at this stage prevents future challenges to the trust's validity.

Ongoing administration maintains the trust's compliance status. Regular reviews ensure the structure continues to meet evolving personal circumstances and regulatory changes. Professional trustees provide valuable guidance in adapting to new developments.

What types of assets can I place in a Montenegro Legacy Trust?You can transfer various assets including real estate, investment portfolios, intellectual property, and business interests. The jurisdiction's flexible framework accommodates most asset types, though specific rules apply to certain categories like cultural artifacts or restricted securities.

How does Montenegro's 2025 policy affect existing trust arrangements?Existing trusts generally benefit from grandfathering provisions, though some optional provisions might offer enhanced benefits. Consulting with a local trust expert helps determine whether modifications could improve your current structure under the new regulations.

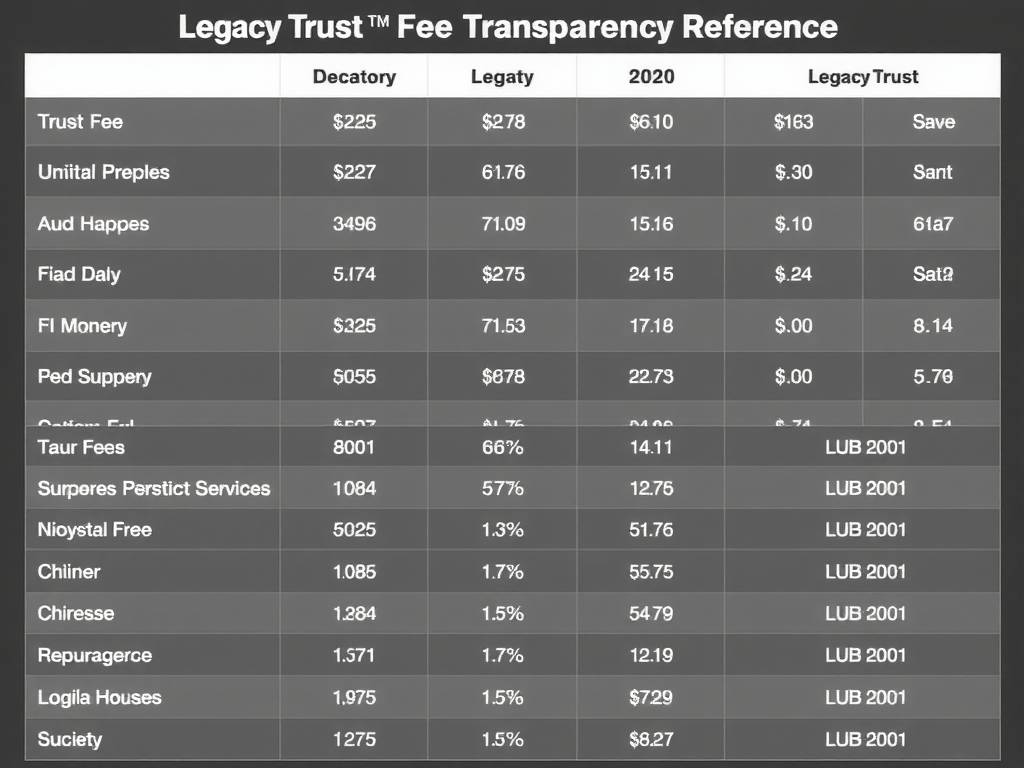

What are the costs associated with maintaining a Montenegro Legacy Trust?Costs vary based on trust complexity and asset value, typically including establishment fees, annual government charges, and professional trustee fees. Most investors find these costs reasonable compared to the tax savings and protection benefits achieved.

Establishing a Montenegro Legacy Trust requires careful planning and professional guidance. The jurisdiction's favorable legal framework, combined with the 2025 policy enhancements, creates significant opportunities for wealth preservation and tax optimization. By understanding the key considerations and working with experienced professionals, you can develop a robust strategy that protects your legacy while maximizing tax efficiency. The time to act is now, before global tax transparency initiatives further limit planning opportunities.

发表评论