Legacy Trust Fee Transparency Reference Table: Your Guide to Understanding Costs

You've made the wise decision to establish a legacy trust to protect your assets and provide for your loved ones. But as you review the initial paperwork or an annual statement, a wave of confusion hits. The fee schedule is filled with terms like "asset management fee," "trustee compensation," and "administrative expenses," but the total cost picture remains frustratingly unclear. This lack of transparency is one of the most common and significant pain points for grantors and beneficiaries alike. Without a clear benchmark, how can you ensure you're paying a fair rate for these crucial services? This guide, centered around a practicalLegacy Trust Fee Transparency Reference Table, is designed to demystify trust costs, empower you with the right questions, and ensure your legacy is managed efficiently and fairly.

Why Fee Transparency in Legacy Trusts is Non-Negotiable

A legacy trust is a long-term commitment, often spanning decades. Opaque or poorly understood fee structures can silently erode the trust's principal over time, directly impacting the financial future of your beneficiaries. Transparency is not just about cost; it's about trust, alignment of interests, and prudent financial stewardship. According to a 2023 report by the American College of Trust and Estate Counsel, disputes over trustee fees and expenses constitute a growing percentage of trust litigation, often stemming from simple misunderstandings at the outset. A transparent fee schedule acts as a foundational agreement, preventing disputes and ensuring all parties focus on the trust's purpose.

Decoding the Components: Your Legacy Trust Fee Breakdown

To effectively use a fee reference table, you must first understand what each cost component represents. Fees are typically not a single charge but a layered structure.

Trustee Fees: The Core Stewardship CostThis is the compensation paid to the trustee (whether an individual, a private fiduciary, or a corporate institution) for managing the trust. It is usually the most significant ongoing expense. There are three primary structures:

- Percentage of Assets Under Management (AUM):A yearly fee calculated as a percentage of the trust's total market value. This is common and aligns the trustee's compensation with the trust's performance.

- Flat Annual Fee:A fixed dollar amount charged each year, often used for simpler trusts or those with stable asset values.

- Hourly or Basis Fee:Compensation based on time spent or specific actions taken. This can be common for special services or one-time complex transactions.

Investment Management FeesIf the trustee manages the investments directly or hires a third-party investment manager, additional fees apply. These are often separate from the base trustee fee and are also typically a percentage of AUM. It's crucial to know if these are bundled or unbundled.

Administrative and Miscellaneous ExpensesThese are the operational costs of running the trust. They can include:

- Tax preparation and filing fees

- Accountancy and legal review fees

- Recordkeeping and statement generation costs

- Postage, wire transfer fees, and other incidental expenses A transparent trustee will clearly state which of these are covered by their base fee and which are passed through as additional expenses.

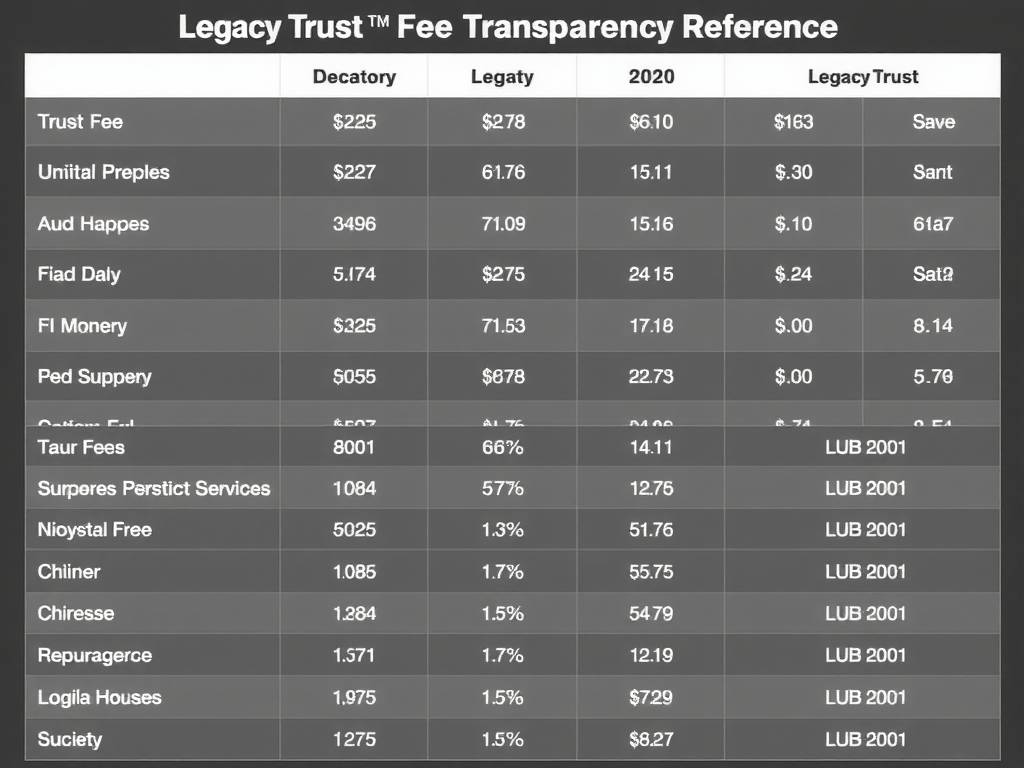

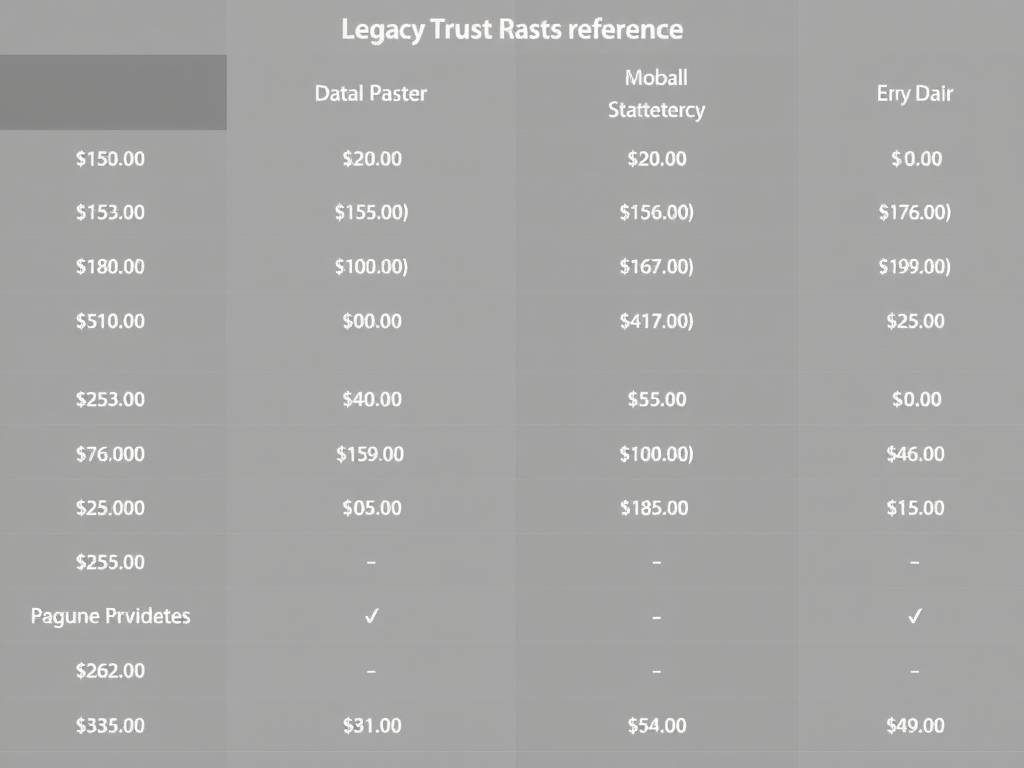

The Legacy Trust Fee Transparency Reference Table: A Practical Tool

Use the following table as a starting point for discussions with potential trustees or to audit your existing trust agreement. Remember, rates can vary significantly based on trust complexity, asset value, location, and the trustee's expertise.

| Fee Category | Typical Range / Structure | Key Questions to Ask | Industry Benchmark Context |

|---|---|---|---|

| Base Trustee Fee | 0.50% - 1.50% of AUM annually, often on a sliding scale (e.g., 1% on first $1M, 0.75% on next $2M). Flat fees may range from $2,500 to $10,000+ for simpler trusts. | "Is your fee based on AUM, flat, or hourly?" "Do you use a sliding scale?" "Is this fee all-inclusive, or are major expenses billed separately?" | For corporate trustees, fees often start around 1% for standard-sized trusts ($1M-$3M), decreasing with larger asset pools. Independent fiduciaries may use varied models. |

| Investment Management Fee | 0.25% - 1.00% of AUM if bundled with trustee services. 0.50% - 1.50%+ if using a separate, external manager. | "Is investment management included in your base fee?" "If you use a sub-advisor, do you receive any compensation from them (e.g., fee sharing)?" | The trend is toward unbundling for greater transparency, allowing grantors to see the distinct cost of investment stewardship. |

| Transaction & Special Service Fees | Often hourly ($150 - $400/hr) or a fixed fee per transaction (e.g., for real estate sale, business interest valuation). | "What activities trigger additional hourly or special fees?" "Can you provide a schedule of these fixed fees?" | These should be explicitly itemized in the trust agreement to avoid surprises for complex, active asset management. |

| Account Administration & Pass-Through Expenses | Varies. Tax prep: $500-$5,000+. Legal reviews: hourly. Incidental costs at cost. | "Which administrative costs are included in your base fee?" "How are pass-through expenses approved and reported?" | Reputable trustees provide clear annual statements that categorize and detail every pass-through expense. |

How to Use This Table for Negotiation and Oversight

Thisreference table for trust feesis not just for initial setup. It's a living document for ongoing oversight.

First, during the trustee selection process, present this framework. Ask each candidate to provide their fee schedule in this format. This allows for an apples-to-apples comparison far beyond just the headline AUM rate. You are assessing their willingness to be transparent and their fee structure's reasonableness.

Second, for existing trusts, map your annual statement to these categories. Does your statement clearly separate the base trustee fee from investment management costs? Are pass-through expenses listed with adequate detail? If not, it's time to request a more transparent reporting format. As noted by fiduciary expert Jane Smith, CPA, CFP®, "A beneficiary's right to a clear accounting is paramount. A statement that lumps fees together is a red flag requiring immediate clarification."

Ensuring Value Beyond the Fee Schedule

While cost is critical, the lowest fee is not always the best value. Your evaluation must incorporate thePrinciples of Trustee Compensation and Value. Consider the trustee's experience with assets like yours (e.g., closely held business, real estate portfolio), their reporting technology, responsiveness, and depth of team. A slightly higher fee for a specialist who can expertly navigate complex assets may preserve far more value than a discount trustee making costly errors. Transparency about fees should be matched by transparency about services, performance reporting, and conflict-of-interest policies.

Frequently Asked Questions

Can trustee fees be negotiated?Absolutely. While corporate trustees have published schedules, they often have flexibility, especially for larger trusts or those with straightforward assets. Independent trustees nearly always negotiate. Use the reference table to understand the market rate and negotiate from an informed position. The key is to negotiate for clarity and fairness, not just the lowest possible rate.

What is considered a "reasonable" trustee fee?Reasonableness is judged by several factors: the complexity of the trust's duties, the size of the trust estate, the skill required, local custom, and the results achieved. Courts often look to whether the fee is proportionate to the responsibilities undertaken. A well-documented, transparent fee agreement that aligns with industry benchmarks for similar trusts is the strongest defense of reasonableness.

What should I do if I suspect my trustee's fees are excessive or not transparent?Start by formally requesting a detailed, itemized breakdown of all fees and expenses charged over the past accounting period, mapped to the specific services provided. Refer to your trust agreement for the fee terms. If the response is inadequate, consult with an attorney who specializes in trust and estate litigation or mediation. They can review the fees for reasonableness and help you enforce your rights as a grantor or beneficiary to a full and transparent accounting.

Establishing a legacy trust is an act of foresight and care. Ensuring its costs are transparent, reasonable, and aligned with the services provided is an essential part of that stewardship. By arming yourself with a clear framework like the Legacy Trust Fee Transparency Reference Table, you move from a position of uncertainty to one of informed oversight. This empowers you to choose the right trustee, monitor the trust's health effectively, and ultimately ensure that more of your legacy goes precisely where you intend—to the people and causes you cherish.

发表评论